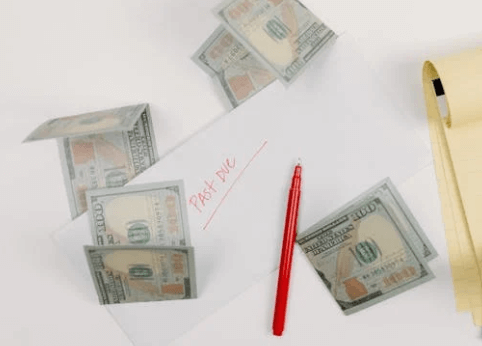

Navigating the challenge of missed payments before foreclosure in Captiva, Florida, can be stressful, but understanding the timeline can make all the difference. Typically, lenders in Florida begin foreclosure after 3 to 6 missed payments, giving homeowners a critical window of 120 days to act. If you’re behind on payments and wondering what your options are, you’re not alone. Expert guidance empowers you to make well-informed decisions with confidence. Steve Daria and Joleigh, renowned real estate investors and cash house buyers, are dedicated to helping homeowners manage missed payments before foreclosure in Captiva, Florida. Their expertise in creating fast, hassle-free solutions could be the key to protecting your financial future. Whether you’re ready to sell quickly for cash or explore personalized strategies, they can guide you every step of the way. Don’t wait for foreclosure proceedings to begin—contact Steve Daria and Joleigh today to schedule a free consultation and regain control of your situation.

What is the process of foreclosure in Captiva, Florida?

The foreclosure process in Captiva, Florida, typically begins after a homeowner misses several mortgage payments, with lenders often starting the process after 3 to 6 missed payments.

When this happens, the lender will issue a formal notice of default, allowing the homeowner to catch up on payments.

If the homeowner cannot resolve the issue, the lender may file a legal case with the court to start the formal foreclosure process.

At this point, the homeowner will receive a summons and complaint, and they will have a limited time to respond or contest the foreclosure lawsuit.

If no steps are taken, the court may authorize the lender to sell the property through a public auction.

It’s important to note that Florida is a judicial foreclosure state, meaning all foreclosures must go through the court system.

Understanding these steps for those dealing with missed payments before foreclosure in Captiva, Florida, is crucial to exploring possible solutions and alternatives.

Taking quick action, such as contacting your lender or seeking financial assistance, can sometimes help delay or avoid foreclosure altogether.

Get An Offer Today, Sell In A Matter Of Days

How many missed payments can lead to foreclosure in Captiva, Florida?

In Captiva, Florida, the number of missed payments required to trigger foreclosure often varies based on the lender’s specific policies.

Generally, most lenders allow 3 to 6 missed payments before initiating foreclosure proceedings.

After one or two missed payments, a homeowner will usually receive warning notices or calls from the lender.

If payments remain overdue, the lender may issue a formal notice of default—an official warning that foreclosure proceedings could begin if the issue is not resolved.

Once this happens, the homeowner is given time to catch up on the outstanding balance or work out a plan with the lender.

If no action is taken, the lender may file a lawsuit to start foreclosure.

Understanding this timeline is important because dealing with missed payments before foreclosure in Captiva, Florida, can be stressful, and knowing your options early can make a big difference.

Taking prompt action, like seeking financial assistance or exploring loan modifications, can help prevent the situation from worsening.

What options are available if I can’t make my mortgage payments?

- Talk to Your Lender: Contact your lender quickly to explain your situation. Many lenders offer options like temporary payment pauses or loan adjustments to help you manage your payments.

- Apply for a Loan Modification: A loan modification adjusts the terms of your mortgage to make payments more manageable. This may involve reducing your interest rate, extending the repayment period, or lowering the total balance owed.

- Look into Refinancing: If you qualify, refinancing your mortgage can reduce your monthly payment. This involves swapping your current loan for a new one with better terms that better fit your budget.

- Consider Selling Your Home: Selling your property, especially if it has equity, can help you avoid foreclosure. This option lets you pay off your mortgage and have leftover funds to start fresh.

- Explore Government Assistance Programs: Federal or state programs are available to help homeowners struggling with mortgage payments. These programs can provide financial aid or guidance during tough times.

What assistance programs are available in Florida to prevent foreclosure?

Florida offers several assistance programs to help homeowners facing financial hardship and prevent foreclosure.

One option is the Florida Homeowner Assistance Fund, which provides financial aid to cover missed mortgage payments or other housing-related expenses.

This program is designed for those who have experienced income loss due to unexpected circumstances like job loss or medical emergencies.

HUD-certified housing counseling agencies provide free or low-cost services like financial counseling and assistance with negotiating with lenders.

For veterans, programs like those offered by the VA provide support, including loan modifications or repayment plans.

Borrowers can also explore mediation programs, which create opportunities to work with lenders to find feasible payment solutions before foreclosure starts.

If you’re dealing with missed payments before foreclosure in Captiva, Florida, connecting with these programs early can make a big difference.

Additionally, nonprofits and local community organizations may also provide grants, legal aid, or financial counseling to help you stay in your home.

Taking advantage of these support options can often delay or prevent foreclosure altogether.

How does selling my property during pre-foreclosure impact my credit?

- It Can Prevent a Full Foreclosure on Your Record: Selling your home during pre-foreclosure can stop the foreclosure process before it is finalized. This is important because a full foreclosure stays on your credit report for up to seven years and significantly lowers your credit score.

- Your Credit Score May Still Drop: Selling your home to avoid foreclosure won’t remove missed mortgage payments from your credit report. These late payments might lower your score, but the impact is usually less severe than a completed foreclosure.

- It Shows Lenders You Took Action: By selling your property, you’re resolving the issue, which can look better to future lenders. It demonstrates responsibility and may make it easier for you to qualify for loans down the road than if you’d gone through foreclosure.

- You Might Avoid Deficiency Judgments: If the sale covers what you owe on the mortgage, you can avoid owing additional money to your lender. This can shield your credit from further damage caused by unpaid debt after a foreclosure.

- You Can Start Rebuilding Your Credit Faster: Selling during pre-foreclosure allows you to move forward sooner and begin rebuilding your financial situation. Without a full foreclosure hanging over your report, you may find it easier to repair your credit over time.

What steps should I take immediately after missing a mortgage payment in Captiva, Florida?

If you’ve missed a mortgage payment in Captiva, Florida, it’s important to act quickly to protect your financial future.

The first step is to reach out to your lender as soon as possible and clearly explain your situation.

Many lenders offer options like forbearance, repayment plans, or loan modifications to help homeowners get back on track.

Additionally, review your budget to determine if there are any expenses you can cut to prioritize your mortgage payments.

Remember, missed payments before foreclosure in Captiva, Florida, can add up quickly, so staying proactive can make a huge difference.

You should also seek advice from professionals, such as a HUD-certified housing counselor, who can guide you through options like financial assistance programs or mediation services.

If keeping your home isn’t possible, you might consider selling your property to avoid damaging your credit further.

Steve Daria and Joleigh, seasoned real estate investors and cash house buyers, can help you quickly sell your home and confidently move forward.

Don’t wait until it’s too late; reach out to experts and explore your options today.

Takeaway

- Lenders Typically Allow 3 to 6 Missed Payments Before Foreclosure: Most lenders in Captiva, Florida, start foreclosure after 3 to 6 missed payments. This may change based on the lender’s rules and the borrower’s situation.

- Missed Payments Can Lead to Serious Penalties: Missing payments can result in late fees and harm your credit score. Multiple missed payments increase the risk of foreclosure and make it harder to catch up on your debts.

- Early Communication With Your Lender Can Help: Reaching out to your lender as soon as you miss a payment can open up options like forbearance or repayment plans. Many lenders are open to collaborating with homeowners to prevent foreclosure.

- Seeking Professional Help Is Important: Financial counselors and housing experts can guide you through your options if you struggle to make payments. They may also connect you with programs designed to provide mortgage relief in Captiva, Florida.

- Proactive Steps Can Prevent Foreclosure: Selling your home, applying for payment assistance, or negotiating loan modifications could prevent foreclosure. Acting early and knowing your options can significantly minimize missed payments’ financial and emotional impact.

**NOTICE: Please note that the content presented in this post is intended solely for informational and educational purposes. It should not be construed as legal or financial advice or relied upon as a replacement for consultation with a qualified attorney or CPA. For specific guidance on legal or financial matters, readers are encouraged to seek professional assistance from an attorney, CPA, or other appropriate professional regarding the subject matter.